Question for Jim:

Between keeping my business going, getting everyone paid, keeping the lights on and our trucks running, there’s not much left over to save for my retirement. What do you recommend owners like me do about retirement savings?

My Answer for Retirement-Minded Owners

This is a unique and important issue almost all small business owners confront (or ignore). If you were an employee, at least in some cases, the answer would center around saving and investing through a retirement plan at work. But for business owners, the answer depends and is more complicated than it is for employees!

As an owner, when you think about “saving for retirement,” in addition to thinking about what you should be socking away, you should also think about maximizing the value of your business.

Inexact-but-Helpful Rules of Thumb

PERFORMIDABLE does not provide investment advisory services, and none of the following is intended to provide such guidance or specific advice for anyone. But as a general rule of thumb, to retire at 65 think about your retirement nest egg needing to be 20-25x or more of your first year’s retirement savings draw need.

So, let’s say you and your spouse are expecting a total of $30,000 a year from Social Security and need $70,000 a year to cover your annual retirement expenses. That means your year one retirement savings draw would be about $40,000 ($70,000 - $30,000) and 20-25x of that amount equals $800,000 – $1 million.

This math applies whether you’re an employee or an owner. But owners are different because by definition they own a business – which hopefully has at least some re-sale value.

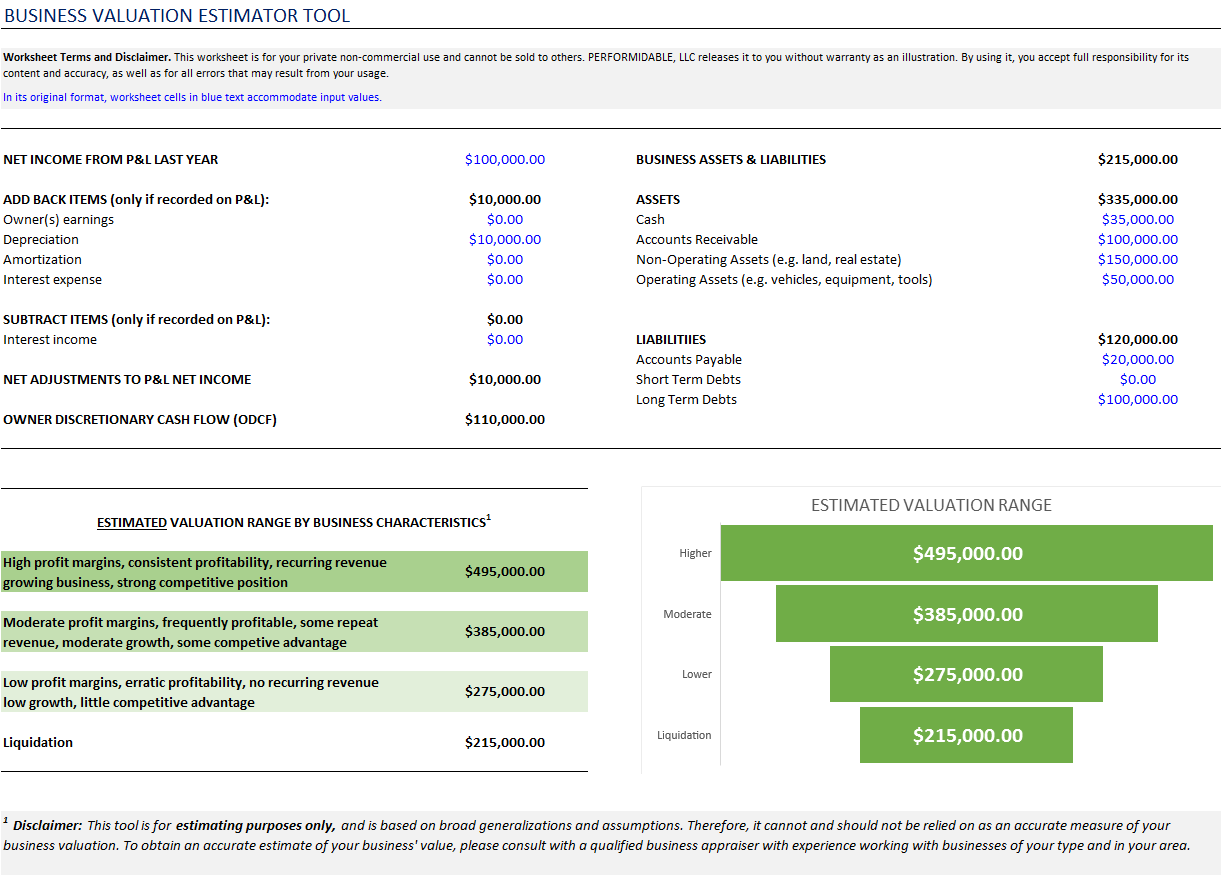

To add that twist to this question, as another general rule of thumb consider that trade service and construction businesses sometimes sell in the range of 1-3x “Seller’s (or Owners) Discretionary Cash Flow” (SDCF), though this is by no means a fixed or assured valuation multiple range. SDCF is your business’ net income before your draw is taken, before taxes, and with some other adjustments.

Assuming SDCF for your business was $150,000 and you multiplied that by 1-3x, a quick and dirty valuation estimate gives you $150,000 to $450,000. Ignoring gains taxes, debt, and transaction costs and other variables, that would imply your business valuation might make up 15% - 45% of your retirement “nest egg” if your retirement savings goal were $1M.

Of course this is a complex equation with many moving parts, and this very simplified example is only intended to help guide your thinking. The key issues to focus upon are the questions of: (1) where you are going to build monetary value for your retirement, and (2) how much so.

Are you going to build resources through your business’ value? Or through retirement savings? Or through both? And in what proportion?

In the real world, the answer is that most people – including business owners – don’t save enough for retirement. So, if you don’t want to be in that position, the first step is to commit to be different.

Commit to be prepared to retire. Commit to make your business as valuable as it can be. Commit to save at least some of your business income for retirement (and for other things).

To make your business as valuable as it can be – which we encourage all owners to do – you need to focus on establishing and maximizing the key Business Value Builders below that buyers will look for when you are ready to sell or retire:

Business Value Builders

- Strong profits

- Recurring revenue

- A strong and cohesive team in place that can run your business without you

- An evergreen, high-need or high-demand product or service

- Committed customers

- Efficient and systematized operations

The key is this: business buyers pay the best prices for and are quickest to bite on successful businesses they know will continue thriving over the long haul and not skip a beat when the selling owner (i.e. you) is no longer running the show. That combination of characteristics, to us, is the very definition of “PERFORMIDABLE.”

If you want to retire, you as an owner need to make it your lifelong “retirement savings” work to get all these characteristics in place in your business! And, by retirement, you need to scale your business to a size large enough that its re-sale value is sufficient enough to fund whatever part of your retirement that won’t be covered by retirement savings or other income streams.

If you’ve got no idea what your business value may be or how to approximate it, we’ve got you covered with a handy tool to help you gauge a ballpark estimate! It is available for download in the Tools section of our website and also using the button below:

If for whatever reason you own a business that is not and cannot become valuable enough to fund your retirement, then conventional-style retirement savings is the approach to take.

To turn the points in the previous section on their head, you should know that your business will have little or no re-sale value if it has these characteristics when you seek to cash out:

Value Killers

- Weak or no profits

- Zero recurring revenue

- A divided, ill-trained, un-empowered-staff that can’t run your business without you

- A trendy or dying product or service or one of questionable long-term demand

- Dissatisfied and uncommitted customers

- Inefficient operations and no systems

- A business that is likely to substantially decline or cease in your absence

Businesses with these characteristics cannot be counted on to provide significant retirement benefit to their owners.

Retirement Savings Basics for Small Businesses

Regardless of whether your business has or will have strong re-sale value or not, owners should know the options they have for saving for their own retirement and for offering a retirement savings vehicle to their employees.

This is beyond the scope of our focus at PERFORMIDABLE, and so we recommend you find that information elsewhere. To help you, below we make reference to three large and well-known financial firms that offer investment products and services for retirement. We have no business affiliation with any of them and you will be on your own to evaluate them.

As you will see, small business retirement plan choices typically boil down to: SIMPLE IRAs, SEP-IRAs, 401(k), and in some cases a Single or Self-Employed 401(k). Further, owners and employees are also typically eligible to save/invest through traditional and Roth IRAs.

Vanguard

https://investor.vanguard.com/what-we-offer/small-business/overview

https://investor.vanguard.com/ira/iras

Fidelity

https://www.fidelity.com/retirement-ira/small-business/overview

https://www.fidelity.com/retirement-ira/overview

Schwab

http://www.schwab.com/public/schwab/investing/accounts_products/accounts/small_business_retirement

http://www.schwab.com/public/schwab/investing/accounts_products/accounts/ira

While these firms provide information and services aimed at assisting investors, our focus will remain upon helping you do the things that will maximize the value of your business over time!

We've Got You Covered

So count on us to provide you lots of ongoing help and guidance as you “save for retirement” by improving your business and its value!

To follow us regularly on our blog, bookmark www.performidable.com/blog today.

And any time you have a question - like this one - that you'd like me to answer, submit it on our Ask Jim page at: http://www.performidable.com/ask-jim/.

We look forward to helping you build a great business over time, and ultimately one that will enable you to retire in style!

Long live small business! Long live small business owners!

Jim Smith, Founder. PERFORMIDABLE, LLC